In the military, we don’t just rush into missions without strategy. Every move is calculated, intentional, and aligned with a bigger goal. Your approach to wealth should be the same.

If you’ve ever invested in real estate or thought about doing it, you already understand the long-game: cash flow, appreciation, and ownership. Now what if I told you… you could do the same thing with stocks?

This isn’t about day trading or gambling on penny stocks. This is about shifting your mindset — treating stocks like real estate to build long-term, income-producing wealth.

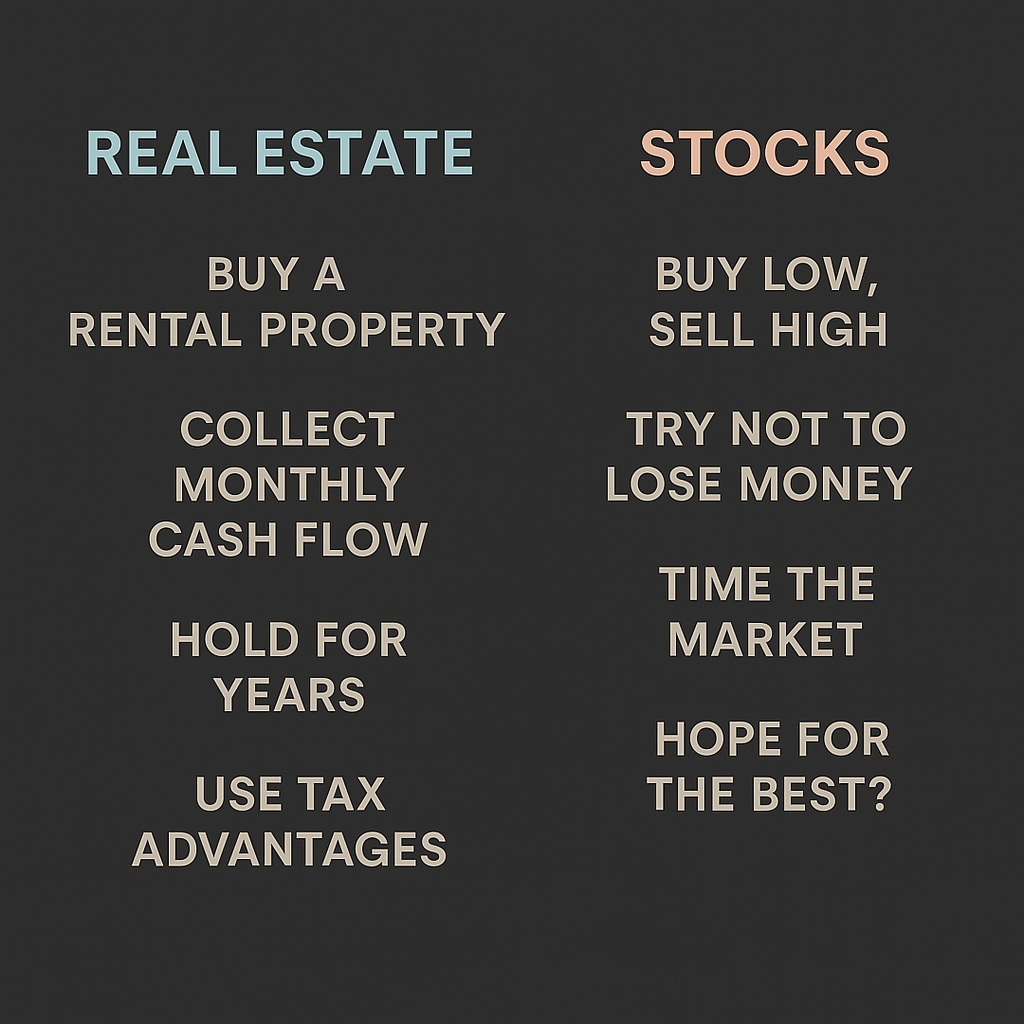

Stocks vs. Real Estate: Why the Mindset Shift Matters

Most people approach the stock market like a casino. Buy low, sell high, hope you don’t lose your shirt.

That’s not investing. That’s wishful thinking.

Now contrast that with how people treat real estate:

- Buy a rental property

- Collect monthly cash flow (rent)

- Hold for years while the property appreciates

- Use tax advantages to your benefit

That’s a plan. That’s a system.

And here’s the truth: you can apply that exact same model to the stock market.

Think of Dividend Stocks as Rental Properties

Every dividend-paying stock is like a rental property. Instead of tenants, you have a company paying you regular income. Instead of dealing with plumbing issues or vacancy, you’re collecting dividends with a click of a button.

✅ Dividend = Monthly Cash Flow

✅ Appreciation = Stock Price Growth

✅ Reinvestment = Property Upgrades

You can reinvest those dividends using a DRIP (Dividend Reinvestment Plan) and watch your portfolio grow — like adding more square footage to a house without swinging a hammer.

How to Find “Cash-Flowing” Stocks

Not all stocks are created equal. Just like real estate, location and quality matter.

When you’re looking for cash-flowing stock opportunities, focus on:

- Dividend Yield – A solid yield (3–5%) is a good start, but don’t chase sky-high numbers.

- Payout Ratio – Tells you if the dividend is sustainable. Look for companies paying out less than 70% of their earnings.

- Dividend Growth – Is the company increasing its dividend year after year?

- Industry Stability – Utilities, consumer goods, healthcare… think recession-resistant.

💡 Pro Tip: Look into Dividend Aristocrats — companies that have increased their dividend for 25+ years straight. That’s a strong track record of reliability.

Portfolio Management = Property Maintenance

Just like you’d check in on your rental property, you’ve got to do the same with your portfolio.

✅ Review earnings reports like you’d inspect a roof.

✅ Adjust allocations like you’d repair a leaky faucet.

✅ Cut bad stocks like offloading a property that’s draining your wallet.

Investing isn’t passive. It’s proactive. You’re the asset manager here.

The Tax Advantages: Stocks Win Again

Both real estate and stocks offer tax benefits, but dividend investing can be even more flexible:

- Qualified dividends are taxed at lower long-term capital gains rates.

- Tax-advantaged accounts (like IRAs, Roth IRAs, or SEP IRAs) can grow your money tax-free or tax-deferred.

- Liquidity is better. Selling a stock takes seconds — selling a house takes months.

Case Study: $10K in Stocks vs. $10K in Real Estate

Let’s say you invest $10,000 in a dividend stock portfolio yielding 4%. That’s $400/year in cash flow — not including price appreciation or reinvestment.

Now compare that to a $10K down payment on a rental:

- You’ve got property taxes, maintenance, potential vacancies

- That $400/month in rent might net $200 after costs

- And if something breaks? You’re writing a check

Meanwhile, your dividend stock is working while you sleep — no tenants, no toilets, no termites.

Why Veterans and Entrepreneurs Should Use This Strategy

Discipline. Long-term focus. Mission-first thinking.

That’s what makes veterans and driven entrepreneurs perfectly wired for this strategy. You’re not looking for a quick win — you’re building something that lasts.

And unlike real estate, you don’t need a credit score, a loan, or a physical asset. You just need the right education and the right mindset.

Ready to Start? Here’s Your Action Plan

You don’t need to wait until you’ve “got more money” or “know more.” You just need to move with intention.

- Open a brokerage account (Fidelity, Schwab, M1 Finance, etc.)

- Research 3–5 quality dividend stocks using the tips above

- Set up automatic investments weekly or monthly

- Enable DRIP (Dividend Reinvestment Plan)

- Track your dividend income growth quarterly

This is how you build wealth brick by brick. No guesswork. No hype. Just strategy.

Final Thoughts: Invest With a Builder’s Mindset

If you’ve ever built something from scratch — a career, a business, a life after service — you know it takes patience, vision, and relentless execution.

Building wealth is no different.

Treat every stock like it’s a property in your portfolio. Every dividend like rent. Every reinvestment like a property upgrade. That’s how you win the long game — and that’s what Warrior Wealth is here to teach.

💥 Want Help Building Your Stock Options Strategy

Grab my eBook guide or book a call with me directly.

I’ll help you create a plan that aligns with your mission, your goals, and your future.

👉 Get the Trading Indicators and Mentorship

👉 Grab the eBook NOW